We assure a Price match

Guarantee with any Becker Partner

Take The First Steps!

STEM-Powered Accounting

Degree from the USA

STEM-Powered Accounting

Degree from the USA

Launch Your Career with Confidence

Quality Education Guaranteed

We only collaborate with top-tier AACSB-accredited universities in the US. Our only objective is to give you a world-class learning experience that 10x your chances of getting premium job opportunities.

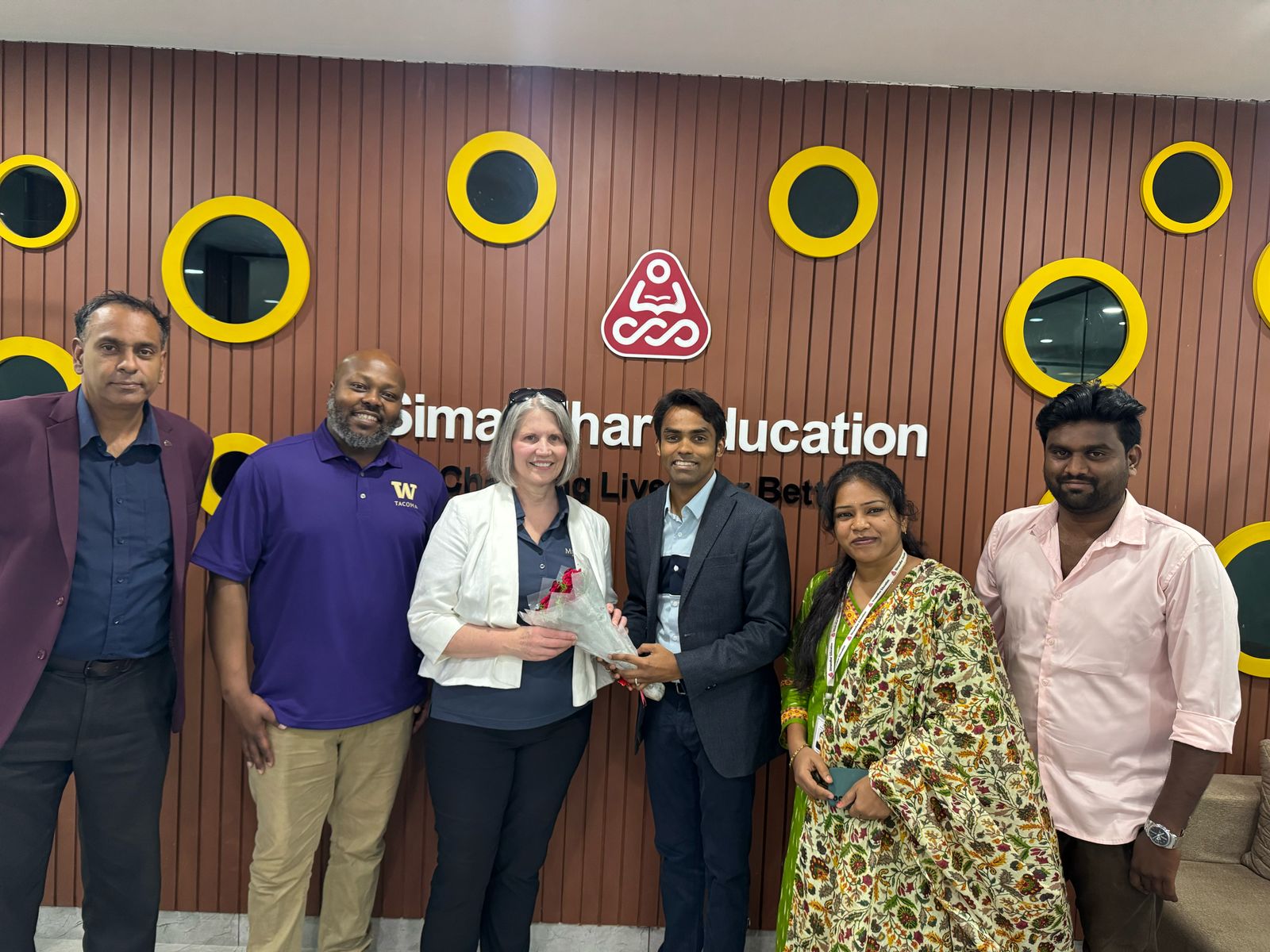

Why University of Washington Tacoma Loves Simandhar Students

What UWT Says About Simandhar Students.. Karen, University of Washington Tacoma:

We love our Simandhar students! They come prepared, they’re smart, they’re ready to engage. They make friends easily, collaborate well with peers from other countries, and truly stand out. We genuinely enjoy having them here — they’ve been great ambassadors for India.”

Learn While You Earn —The STEM OPT advantage in the U.S.

Supercharge Your U.S. Career with right STEM designated program

A STEM-designated master’s in accounting from the USA equips students with advanced analytical and technological skills for data-driven financial decision-making and makes them eligible for up to 3 years of OPT (post graduation).

Earn $50,000 - $100,000+ Per Year

Handholding You Every Step of the Way

STEM Accounting graduates with CPA and a Master’s degree can secure high-paying roles in the US, leveraging extended OPT work authorization to maximize career growth.

| Simandhar | Others |

|---|---|

| ✔️ Affordable US Direct Pathway | ❌ Exploitative profit motives |

| ✔️ No credit transfer hassle | ❌ Pay up to $7000 for credits |

| ✔️ 1-year Master’s (networking focus) | ❌ Shorter programs, limited exploration |

| ✔️ Not 100% free placements, no fake guarantees | ❌ Fake placement guarantees, hidden fees ($5000), no refund |

| ✔️ No binding agreements | ❌ Unfair agreements, legal threats |

| ✔️ Top-tier universities with CPT/OPT | ❌ Day 1 CPT? False promises! |

| ✔️ Free initial guidance, minimal later | ❌ Expensive guidance, high fees (20k) |

| ✔️ Recommends capable students (CPA/CA/work-ex) | ❌ Sends any students, sell extra courses |

| ✔️ No unnecessary courses | ❌ More courses = More $$$ |

| ✔️ Global student mix, cultural exchange | ❌ Lacks diversity = Less opportunity |

| Simandhar | Others |

|---|---|

| ✔️ Affordable US Direct Pathway | ❌ Exploitative profit motives |

| ✔️ No credit transfer hassle | ❌ Pay up to $7000 for credits |

| ✔️ 1-year Master’s (networking focus) | ❌ Shorter programs, limited exploration |

| ✔️ Not 100% free placements, no fake guarantees | ❌ Fake placement guarantees, hidden fees ($5000), no refund |

| ✔️ No binding agreements | ❌ Unfair agreements, legal threats |

| ✔️ Top-tier universities with CPT/OPT | ❌ Day 1 CPT? False promises! |

| ✔️ Free initial guidance, minimal later | ❌ Expensive guidance, high fees (20k) |

| ✔️ Recommends capable students (CPA/CA/work-ex) | ❌ Sends any students, sell extra courses |

| ✔️ No unnecessary courses | ❌ More courses = More $$$ |

| ✔️ Global student mix, cultural exchange | ❌ Lacks diversity = Less opportunity |

Who Made It

Listen to what they have to say

- Earn $50,000–$100,000+ per year in the US or in India

- Work with Big 4 and Fortune 500 companies

- Secure a 3-year OPT visa.

- Fast-track your way to senior business roles

3 Years

- Earn $50,000–$100,000+ per year in the US or in India

- Work with Big 4 and Fortune 500 companies

- Secure a 3-year OPT visa.

- Fast-track your way to senior business roles

Our Students Living the American Dream

STEM stands for Science, Technology, Engineering, and Mathematics. It is an acronym used by federal and state governments in the US to categorize and group together fields of study and career paths that are centered on the above four disciplines. STEM education and careers are characterized by their emphasis on problem-solving, critical thinking, innovation, and the application of scientific, technological, and mathematical principles to real-world problems and scenarios.

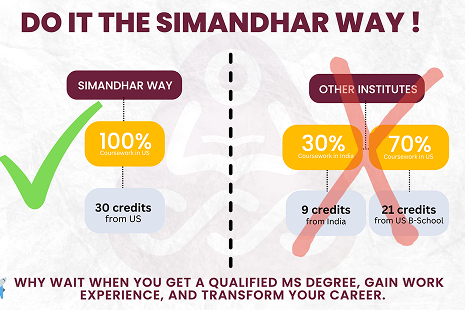

Degree programs in the USA that can be classified as STEM, such as MS in Accounting or MS in Accounting, aim to establish a solid foundation for students in the areas of science, technology, engineering, and mathematics. These programs equip students with the skills required for several career paths, such as accounting analytics and the inclusion of the latest emerging software such as SAP, PowerBI, Tableau, etc. Typically, a master's degree program is one year long and would be around 30 credits.

Yes, there is an immediate shortage, and it can be researched using reliable resources like WSJ. Please refer to the below link: Click here

There are countless reasons why you should consider going to the US. Firstly, the United States is undoubtedly the number one destination for education in STEM fields. (Science, Technology, Engineering, and Mathematics) With state-of-the-art educational infrastructure, facilities, and educational environment, learning from faculty who are among the finest in the world, not to mention the practical training and exposure that you get, is unmatched. This is why so many people, from China to India, flock to the US every year for education. This also brings in many other benefits, such as achieving financial stability, expanding your career prospects, exploring global opportunities and research, and, of course, upskilling yourself with the latest technological advancements. What more do you need?

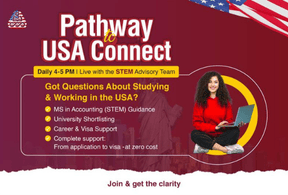

Although it can be a bit daunting to shortlist from 4500 accredited institutions in the United States, Simandhar has your back covered. We have done our due diligence and researched the right universities that are offering STEM-designated programs with the latest emerging technology and analytics involved in the curriculum. So now, candidates who want to pursue it get the best-fit institutes based on four major factors: cost, location, accreditation, and placements. This is why Simandhar is making a difference by partnering with the right universities and, ultimately, by enhancing and transforming their careers.

STEM stands for Science, Technology, Engineering, and Mathematics. It is an acronym used by federal and state governments in the US to categorize and group together fields of study and career paths that are centered on the above four disciplines. STEM education and careers are characterized by their emphasis on problem-solving, critical thinking, innovation, and the application of scientific, technological, and mathematical principles to real-world problems and scenarios.

Degree programs in the USA that can be classified as STEM, such as MS in Accounting or MS in Accounting, aim to establish a solid foundation for students in the areas of science, technology, engineering, and mathematics. These programs equip students with the skills required for several career paths, such as accounting analytics and the inclusion of the latest emerging software such as SAP, PowerBI, Tableau, etc. Typically, a master's degree program is one year long and would be around 30 credits.

Yes, there is an immediate shortage, and it can be researched using reliable resources like WSJ. Please refer to the below link: Click here

There are countless reasons why you should consider going to the US. Firstly, the United States is undoubtedly the number one destination for education in STEM fields. (Science, Technology, Engineering, and Mathematics) With state-of-the-art educational infrastructure, facilities, and educational environment, learning from faculty who are among the finest in the world, not to mention the practical training and exposure that you get, is unmatched. This is why so many people, from China to India, flock to the US every year for education. This also brings in many other benefits, such as achieving financial stability, expanding your career prospects, exploring global opportunities and research, and, of course, upskilling yourself with the latest technological advancements. What more do you need?

Although it can be a bit daunting to shortlist from 4500 accredited institutions in the United States, Simandhar has your back covered. We have done our due diligence and researched the right universities that are offering STEM-designated programs with the latest emerging technology and analytics involved in the curriculum. So now, candidates who want to pursue it get the best-fit institutes based on four major factors: cost, location, accreditation, and placements. This is why Simandhar is making a difference by partnering with the right universities and, ultimately, by enhancing and transforming their careers.

like CPA, CMA, EA, and CIA.

.png)

.jpeg)

.jpeg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)