We assure a Price match

Guarantee with any Becker Partner

Take The First Steps!

CMA: Certified Management Accountant

#Think CMA =Think Simandhar

Accelerate your US CMA journey with India’s most trusted training provider and Becker’s exclusive partner.

Simandhar Education, an IMA Gold Learning Partner, offers the perfect blend of globally recognized Becker content and India’s best-in-class mentorship, smart tools, and career support.

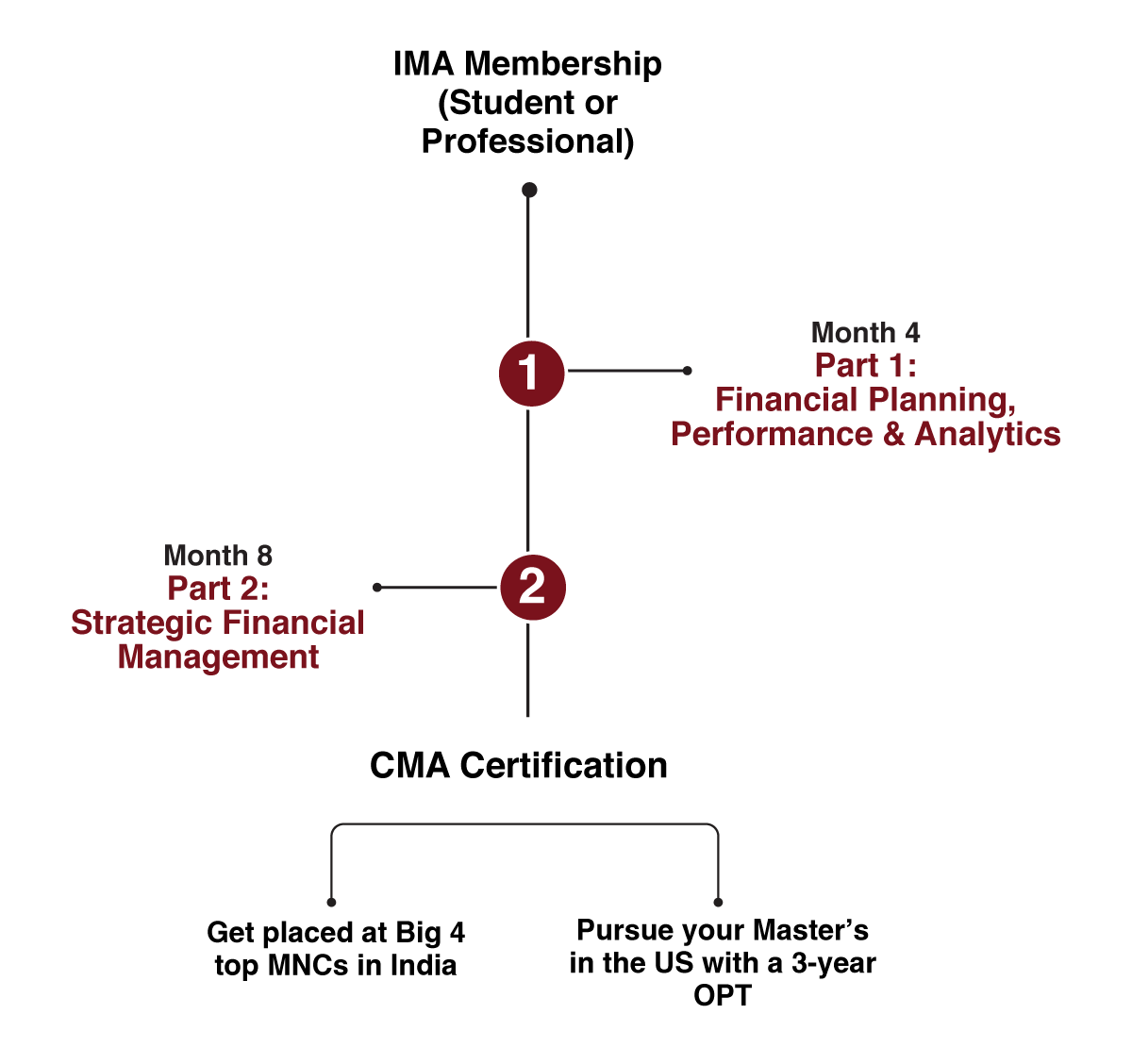

Part 1 - Financial Planning, Performance, and Analytics

Part 2 - Strategic Financial Management

To earn the CMA certification, you must also have two years of professional experience in accounting or finance

Accountant (CMA)

Part 1 - Financial Planning, Performance, and Analytics

Part 2 - Strategic Financial Management

To apply for a certificate, you need two years of professional experience in Accounting or Finance.

Why Did Becker Choose only Simandhar for CMA in India?

- Part 1: Financial Planning, Performance, and Analytics

- Part 2: Strategic Financial Management

Register & access Simandhar’s AI-driven LMS and Becker study materials.

- Part 1: Financial Planning, Performance, and Analytics

- Part 2: Strategic Financial Management

Gain a globally recognized CMA credential and expand your career opportunities.

Leverage Simandhar’s exclusive job portal & Big 4 tie-ups to land your dream job.

Start your career as a Financial Analyst, Risk Manager, CFO, or Tax Consultant.

.png)

US CMA Course Fees

AI Mentor

.jpg)

AI Mentor

.jpg)

AI Mentor

.jpg)

AI Mentor

.jpg)

Who Made It

Listen to what they have to say

.png)

.png)

Like we have Cost accountants in India, the US cost accountants are known as US CMA (Certified management accountants), the US CMA qualification is governed by IMA (Institute of Management accountants).

There are lot of US companies operating in India, for example- Accenture, Capgemini, Cognizant, World bank, Genpact- majority of them hire US CMA for FP&A profile- Financial planning and analysis, US CMA enjoys global recognition, thus there is ever increasing demand for US Certified management accountants in India.

As per the IMA survey, US CMAs earn around $101,000 annually in the US. In India, starting salaries typically range from ₹3.5–6 LPA. At Simandhar Education, one of our alumni was placed at ₹11.5 LPA—though such packages are rare and depend on individual skillsets.

CMA typically deals with business finance team and CA1 majorly are hired in corporate finance, CMAs popularly known as Cost management are primarily concerned on reporting to internal management, whereas CA report to external stakeholders. So ideally CMA and CA are very different in substance.

CMA (Certified Management Accountant) certification has been the global benchmark for management accountants and financial professionals. The CMA is an advanced professional certification specifically designed to measure the critical accounting and financial management skills. This is especially relevant for success in a business environment.

Like we have Cost accountants in India, the US cost accountants are known as US CMA (Certified management accountants), the US CMA qualification is governed by IMA (Institute of Management accountants).

There are lot of US companies operating in India, for example- Accenture, Capgemini, Cognizant, World bank, Genpact- majority of them hire US CMA for FP&A profile- Financial planning and analysis, US CMA enjoys global recognition, thus there is ever increasing demand for US Certified management accountants in India.

As per the IMA survey, US CMAs earn around $101,000 annually in the US. In India, starting salaries typically range from ₹3.5–6 LPA. At Simandhar Education, one of our alumni was placed at ₹11.5 LPA—though such packages are rare and depend on individual skillsets.

CMA typically deals with business finance team and CA1 majorly are hired in corporate finance, CMAs popularly known as Cost management are primarily concerned on reporting to internal management, whereas CA report to external stakeholders. So ideally CMA and CA are very different in substance.

CMA (Certified Management Accountant) certification has been the global benchmark for management accountants and financial professionals. The CMA is an advanced professional certification specifically designed to measure the critical accounting and financial management skills. This is especially relevant for success in a business environment.

like CPA, CMA, EA, and CIA.